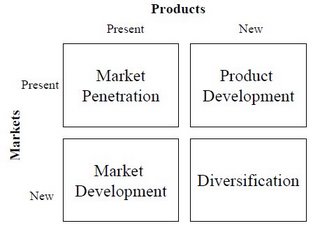

The Ansoff Product-Growth Matrix is a marketing tool created by Igor Ansoff in order to portray alternative corporate growth strategies, focusing on the firm's present and potential products and markets (customers). By considering ways to grow via existing products and new products, and in existing markets and new markets, there are four possible product-market combinations.

The Ansoff Product-Growth Matrix is a marketing tool created by Igor Ansoff in order to portray alternative corporate growth strategies, focusing on the firm's present and potential products and markets (customers). By considering ways to grow via existing products and new products, and in existing markets and new markets, there are four possible product-market combinations.Ansoff's matrix provides four different growth strategies:

- Market Penetration - the firm seeks to achieve growth with existing products in their current market segments, aiming to increase its market share.

- Market Development - the firm seeks growth by targeting its existing products to new market segments.

- Product Development - the firms develops new products targeted to its existing market segments.

- Diversification - the firm grows by diversifying into new businesses by developing new products for new markets.